No, Trump Can’t Bail Out Bitcoin

Even in our Bizarro world, a TARP for tokens rescue is more fantasy than policy—and that’s exactly how the system is designed.

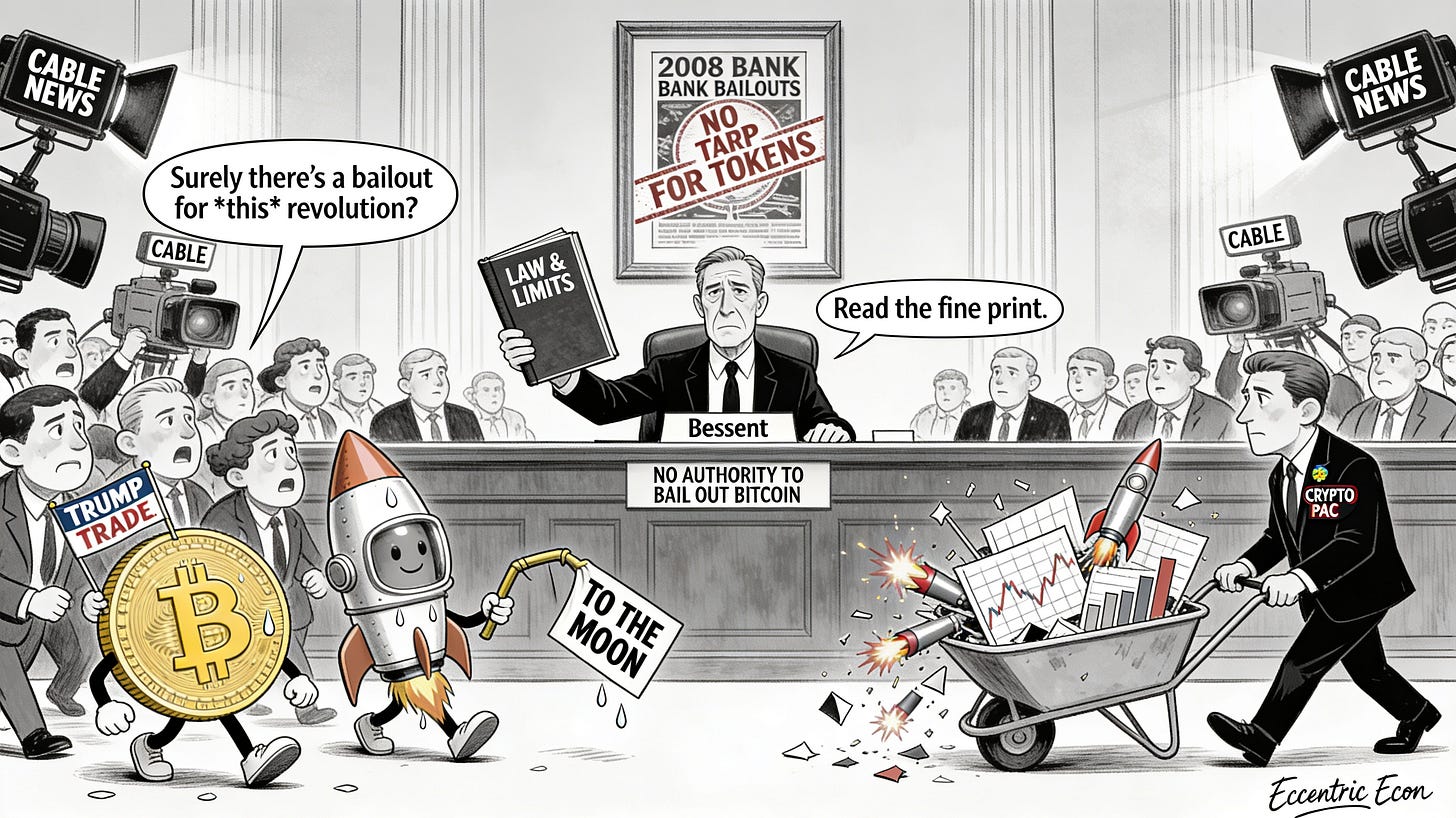

As happens fairly often, I was scrolling Facebook and someone’s post caught my eye. A friend had shared the clip of Treasury Secretary Scott Bessent telling Congress he “does not have the authority” to bail out Bitcoin, and confidently predicted that, of course, the Trump administration would find a way to rescue the crypto industry if this slide kept going. I don’t buy that: not because Trump and his circle lack the desire to save an asset class they have so ostentatiously wrapped themselves around, but because crypto has never made rational sense as a financial instrument and the reckoning we’re living through was structurally inevitable—if anything, its advocates’ decision to turn Bitcoin into a leveraged bet on Donald Trump has only hastened the crash, not increased the odds of a bailout.

When Bessent told Congress he doesn’t have the authority to “bail out Bitcoin,” markets heard a headline; what they should have heard is a civics lesson. This essay is a thought exercise about an option that is politically tempting, conceptually sloppy, and—crucially—legally out of reach, even in the Bizarro‑world of Donald Trump.

The spectacle on the Hill

The exchange was made for television. Long‑time crypto‑skeptic Rep. Brad Sherman pressed Bessent with a 2008‑style hypothetical: could Treasury direct banks to buy Bitcoin, relax regulations to encourage them to hold it, or use public funds to prop up “Bitcoin or Trumpcoin,” as described in coverage of Bessent’s testimony by DL News. Bessent’s answer was simple: no—“I am Secretary of the Treasury. I do not have the authority to do that,” he told lawmakers, a line highlighted in Yahoo Finance’s writeup.

Bitcoin promptly sold off on the “no bailout” comment, slipping below 70,000 dollars in trading that outlets like Yahoo Finance described as a reaction to his remarks. It is a revealing moment for an asset that was born, at least in myth, as a rebuke to bank rescues.

What “bailing out crypto” would actually mean

“Bailout” is doing a lot of work in this discourse. In practice, people seem to mean at least three distinct interventions:

Direct price support: the state buying Bitcoin or other tokens to hold up prices.

Regulatory compulsion: ordering or nudging banks and intermediaries to accumulate crypto, for example by relaxing capital treatment.

Plumbing support: emergency liquidity or guarantees for exchanges, stablecoin issuers, custodians, and other market utilities so they don’t fail in a crisis.

Back in 2008, the U.S. aimed its firepower squarely at the plumbing. Programs like TARP and the Federal Reserve’s emergency 13(3) facilities were designed to recapitalize banks and stabilize short‑term funding markets so that payments, credit, and basic intermediation did not collapse. That’s the distinction drawn in pieces such as CCN’s explainer on why banks got a TARP‑style bailout and Bitcoin won’t.

That project—keeping ATMs and payroll running—is very different from bailing out speculators in a volatile token that everyone understands can go to zero.

Legal constraints: the bailout machine has boundaries

The first reason a Trump‑era crypto bailout is so unlikely is mundane: the statutory authority isn’t there.

Treasury cannot simply decide to deploy taxpayer funds into whatever speculative asset is currently underwater. Its crisis tools are tied to specific programs authorized by Congress, to the Treasury market, and to the regulated banking system—not to the spot price of a bearer token trading on offshore exchanges, a point underscored in reporting such as this Yahoo Finance piece on “no bailout for Bitcoin”. The Federal Reserve’s emergency powers under section 13(3) are framed around lending to institutions against collateral in “unusual and exigent circumstances,” not around buying Bitcoin outright to make traders whole, as law‑and‑finance commentators note when contrasting 2008 bank support with crypto markets in CCN’s analysis.

On top of that sits the Supreme Court’s “major questions” doctrine. Legal scholars have already begun to frame recent crisis interventions as a cautionary tale about agencies discovering vast rescue powers in old statutes, as in the Syracuse Law Review essay, “Major Questions and Moral Hazards: A Tale of Two ‘Bailouts’.” A bespoke TARP‑for‑tokens facility, whose explicit goal is to support the price of a particular crypto asset, would be an engraved invitation for that doctrine.

Congress could, of course, pass a crypto‑bailout statute. The fact that nobody serious is pushing for one tells you almost everything about the politics.

Design choices: crypto lives outside the safety net

There is also a design‑choice argument: crypto grew up outside the public safety net on purpose. Bitcoin’s founding myth centers on the injustice of 2008 bank rescues; its genesis block famously references a U.K. bailout headline, a point often invoked in pieces like CryptoSlate’s reflection on “Bitcoin’s brutal irony”.

The U.S. safety net—deposit insurance, lender‑of‑last‑resort access, structured resolution—attaches to chartered banks and a few other regulated entities, not to free‑floating tokens. When you deposit dollars in an FDIC‑insured bank, you opt into a regime that may socialize losses in a crisis. When you wire money to a Cayman‑registered exchange to buy Bitcoin, you don’t.

Mainstream policy voices have been explicit about preserving that separation. A 2025 report from Brookings, “Protecting the American public from crypto risks and harms,” urges lawmakers to “maintain and reinforce the separation between crypto and traditional financial institutions” precisely to prevent banks and retirement systems from becoming over‑exposed, and even floats limits on the use of public funds to buy or hold cryptocurrencies. That is not a pre‑commitment to future rescues; it is an attempt to make “too big to fail” inapplicable to the token economy.

If crypto wants the upside of living outside the regulated system, it also gets the downside: when things blow up, there is no FDIC cavalry.

Systemic risk: banks versus blockchains

The strongest intellectual case for any bailout is systemic risk: the idea that letting an institution fail will drag down payments, credit, and the broader economy. In 2008, policymakers at least had a coherent story about large, interconnected banks taking down payroll and ATMs with them, the kind of story summarized in post‑mortems like CCN’s review of why banks were saved and Bitcoin is not.

Crypto’s systemic‑risk story is weaker. Official reports tend to highlight three main concerns:

Consumer harms: frauds, hacks, and predatory schemes targeting retail investors.

Spillovers via stablecoins: large dollar‑backed stablecoins holding big piles of Treasuries and bank deposits could, in theory, transmit stress into short‑term funding markets.

Non‑financial externalities: energy use, illicit finance, ransomware, and so on.

Only the second looks like classic “too big to fail.” And even there, the natural response is not “bail out stablecoin holders,” but “regulate reserves, limit integration, and shore up the dollar plumbing,” the kind of approach laid out in the Brookings piece on crypto risks and reflected in the Financial Stability Oversight Council’s softened but still wary 2025 report.

That is exactly what regulators have been trying to do: graft bank‑like requirements onto any crypto entity that wants to be treated like a bank, while otherwise keeping the token universe at arm’s length.

Moral hazard and the Trump factor

Even if the legal authority existed and even if crypto posed more systemic risk than it currently does, there would still be the question of should.

Crypto has been sold to the public as a high‑volatility speculative asset with lottery‑ticket upside and wipe‑out downside, not as a low‑risk savings vehicle. Coverage like NPR’s “Trump promised a crypto revolution. So why is bitcoin crashing?” sketches exactly that speculative ethos around the current downturn (NPR). To then socialize the downside after a decade of privatized gains would be moral hazard on steroids. We saw intense backlash when regulators effectively protected uninsured depositors at crypto‑adjacent regional banks during the 2023 turmoil, and we’ve also seen how backstopping those depositors at Silicon Valley Bank created its own moral‑hazard problems, as I argued in “Bottle Rockets and Falling Skies: How SVB Crashed and Why It’s Not the End of the World” and as the Syracuse Law Review’s “Tale of Two ‘Bailouts’” also emphasizes.

What about Trump specifically? His second administration has done three notable things in this space:

Established a “Strategic Bitcoin Reserve,” seeded with seized BTC and framed as “budget‑neutral,” alongside a broader “digital asset stockpile” of confiscated coins, as described in a White House fact sheet and Reuters’ coverage.

Launched a pro‑crypto working group and filled key roles with industry‑friendly officials, explicitly to “make America the crypto capital of the world,” according to reporting from Politico and CNBC.

Turned crypto into a culture‑war symbol: friend of Bitcoin, foe of CBDCs, champion of “financial freedom,” a posture summarized in overviews like CoinLedger’s guide to Trump and crypto and The Hill’s piece on crypto’s rise as a political force.

All of that is favoritism and symbolism, not a bailout. The political upside for Trump lies in aligning rhetorically with crypto and deregulating at the margins, not in writing checks to losing speculators. That’s why, even in this administration, Bessent has been so emphatic about what he cannot do, as in his “no authority to bail out Bitcoin” remarks covered by Yahoo Finance and Bitcoin Magazine.

The plumbing exception

There is one sliver of the story where something bailout‑like could appear: the plumbing.

If a large, politically connected stablecoin or crypto intermediary became deeply entangled with Treasury markets, then a run there could destabilize short‑term funding. Bessent himself has floated the idea of leaning on dollar stablecoins as buyers of U.S. debt, a theme discussed in coverage of his new plan to finance the government. In that scenario, the Fed and Treasury might intervene to backstop dollar funding or key intermediaries, with crypto along for the ride. From the outside, that would look like a crypto bailout; in substance, it would be the same thing Washington always does in a crunch: protect the plumbing rather than the punters.

Think of it as the difference between rescuing a bank that happens to have crypto‑heavy clients and rescuing the tokens themselves.

The irony: an anti‑bailout asset asking for a bailout

Bitcoin’s origin story is explicitly anti‑bailout; its culture still trades heavily on that mythology. Yet as it has been financialized—held by hedge funds, family offices, and, via wrappers, mainstream investors—it has drifted back into the same orbit of policy speculation as everything else. That is how you end up with markets trading on whether the administration might rescue an asset that was supposed to need no rescue, an irony captured in CryptoSlate’s piece on “Bitcoin’s brutal irony”.

If you take the cypherpunk ethic seriously, Bessent’s “I do not have that authority” should be reassuring. There will be no TARP for tokens. That is not a bug in the system; it is the constraint that keeps crypto from becoming yet another claimant on the public purse.

For the rest of us, the task is simpler: treat “bail out crypto” as the thought experiment it is, and focus on the real margins of policy—limiting spillovers, hardening the plumbing, and refusing to quietly import “too big to fail” into the token economy. Even in Trump’s Washington, that much reality still holds.